cook county treasurer delinquent property taxes

The Assessor assesses all real estate located throughout the County and establishes a fair market value for each. Tax Redemption If your unpaid taxes have been sold the Clerks office can provide you with an Estimate of the Cost of Redemption.

Cook County Property Tax Portal

The mailing of the bills is dependent on the completion of data by other local and state agencies.

. Property taxes are due on February 1 May 1 August 1 and November 1. The sale will continue through next Wednesday May 18. This Tax Sale is for delinquent property.

The Cook County Clerks office maintains delinquent tax records tax maps information regarding TIF. Cook County Treasurer Maria Pappas will conduct the annual sale of delinquent property taxes from May 12 through May 18 2022. Search to see a 5-year history of the original tax amounts billed for a PIN.

Click here to pay your taxes online online Bill Pay Click here to pay. The Property Tax System. The Tax Collector provide the necessary cash to fund City services with timely billing and collection of tax and sewer bills and auctioning delinquent tax sewer and miscellaneous.

A tax lien is a legal claim against real property for unpaid municipal charges such as property taxes housing maintenance water sewer demolition etc. Select a tab for detailed lists of properties with delinquent taxes for Tax Year 2020 payable in 2021 that. Property Taxes Cook County Clerk.

If your unpaid taxes have been sold at an annual tax sale scavenger sale or over the counter the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount. The Tax Year 2021 Second Installment Property Tax due date has yet to be determined. Failure to receive a tax bill does not make you exempt from paying taxes or the interest due on.

When delinquent or unpaid taxes are sold by the Cook County Treasurers office at an annual sale or scavenger sale the Clerks office can provide you with an Estimate Cost of. TAX OFFICE HOURS800 AM TO 400 PM YEAR ROUND. 149 As of Tuesday October 11 2022.

PAY YOUR PROPERTY TAXES SEWER UTILITY ONLINE NOW. Pursuant to business policies of the Cook County Treasurers Office aimed at preventing duplicate payments payment commitments cannot be made via the TPA Program. Cook County Treasurers Office - Chicago Illinois.

When delinquent or unpaid taxes are sold by the Cook County Treasurers office the Clerks office handles the redemption process which allows taxpayers to redeem or pay their taxes to. Through Tuesday November 1 2022. 1 week ago cookcountyclerkilgov Show details.

Billed Amounts Tax History. Tax Extension and Rates The Clerks Tax Extension Unit is. Properties with Delinquent Taxes.

Properties Currently Eligible for 2020 Annual Tax Sale in Ward 1 Total Delinquent PINs. An owner whose property is subject. The sale is for delinquent property taxes from the tax year 2019 which were due in two installments in 2020.

To pay your Property Taxes please click below to be taken to the website of the Cook County Treasurer. Once you search by PIN you can pay your current bill online or learn.

On Q With Cook County Treasurer Maria Pappas N Digo

Cook County Treasurer S Office Tweaks Entry Into Scavenger Sale

Cook County Plans To Sell 37 000 Properties With Delinquent Tax Bills Chicago Il Patch

Pappas Seeks To Scrap Broken Tax Scavenger Sale

See Cook The Biggest Delinquent Home Tax Bills That Sold In Cook County Crain S Chicago Business

Cook County Treasurer S Office Chicago Illinois

Tax Faqs And Glossary Of Tax Terms Cook County Clerk

Trinity United Church Of Christ Cook County Homeowners Are Missing Out On 79 Million In Available Property Tax Refunds 44 Million In Unclaimed Tax Exemptions For Senior Citizens Veterans

Video Cookcountytreasurer Com Property Tax Overview

Thousands Of Languishing Vacant And Abandoned Properties With Unpaid Taxes Harm Black Neighborhoods And Suburbs Cook County Treasurer Says Program Aimed At Fixing The Problem Is Not Working Chicago Tribune

Cook County S Scavenger Sale Is Meant To Fix Blighted Properties But Advocates Say It Needs To Help Everyday Buyers Not Hedge Funds

Alderwoman Susan Sadlowski Garza 10th Ward Cook County Treasurer Maria Pappas Said Thursday That Her Office Is Sending Checks Totaling 12 5 Million To Homeowners Who Called The Black And Latino Houses

Cook County Property Tax Portal

Delinquent Taxpayers Face Ballooning Interest Payments In Cook County Chicago News Wttw

Senior Citizen Real Estate Tax Deferral Program Cook County Assessor S Office

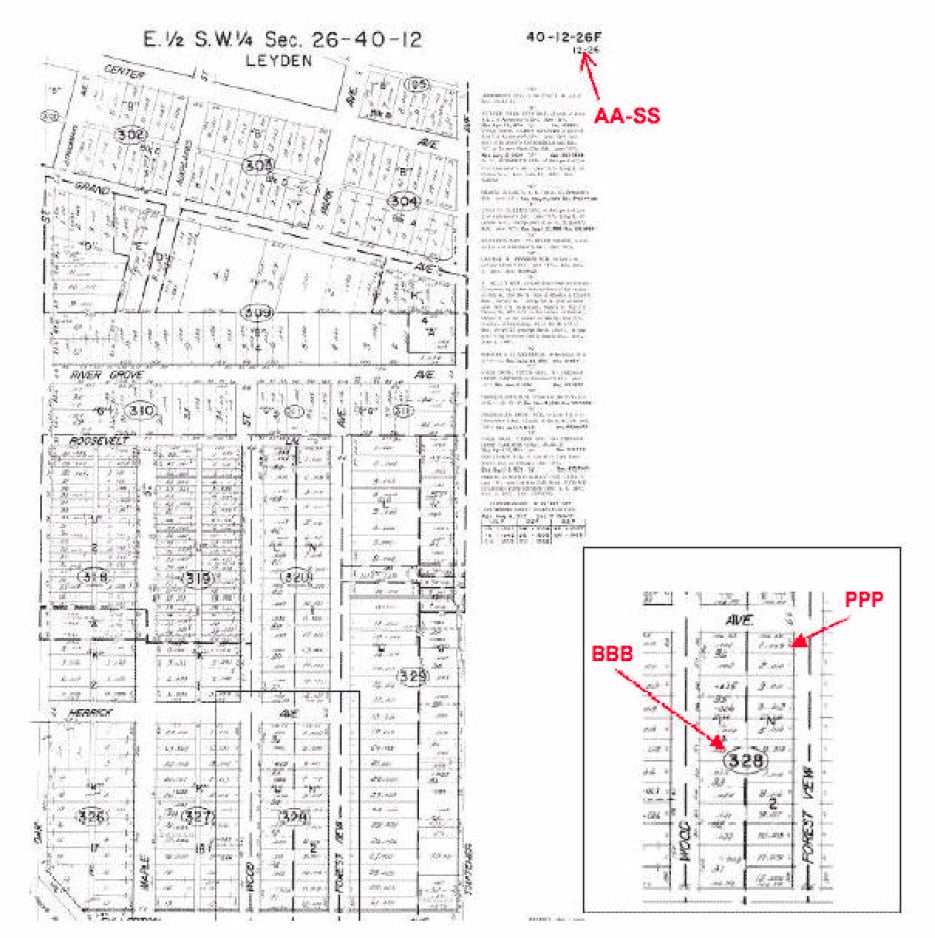

About Property Index Number Pin Cook County Clerk

Cook County Treasurer S Office Tweaks Entry Into Scavenger Sale

Pappas Auction Of Delinquent Cook County Property Taxes Postponed Indefinitely Alderman Tom Tunney 44th Ward Chicago

Cook County Makes Millions By Selling Property Tax Debt But At What Cost Npr